by Matt Galligan

WTF is an NFT? A (relative) beginner's guide to non-fungible tokens and why they matter

What’s in the name?

NFT stands for “non-fungible token.” Fungibility essentially means that something can be broken down and that its subdivided parts are indistinguishable from each other. A bar of gold is fungible because it can be melted down and its remains would be impossible to identify what bar it came from.

Non-fungible represents something that is in and of itself unique—something that cannot be broken down further without destroying what makes it unique.

Digital scarcity

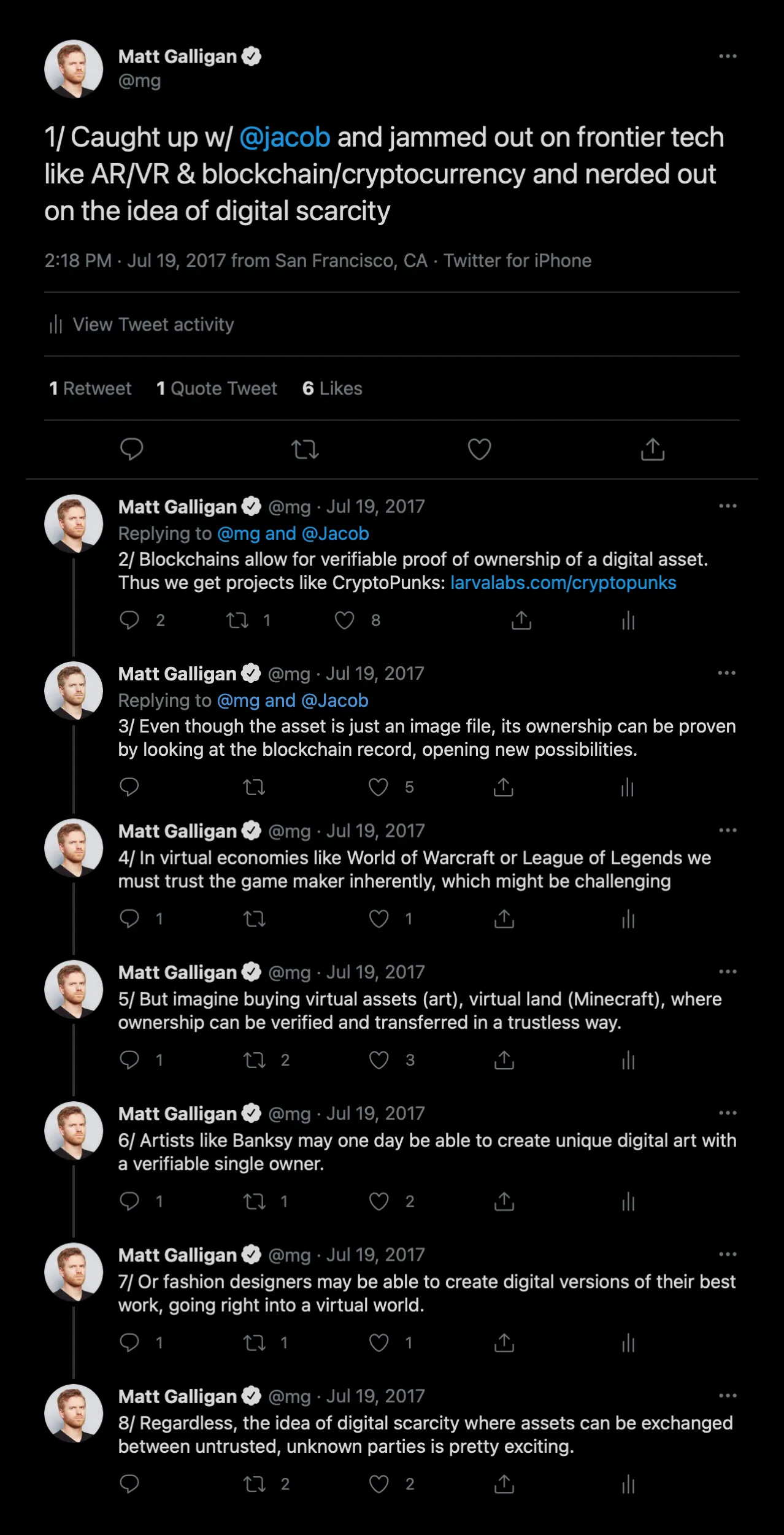

Aside from the advent of trustless stores of value, the single biggest contribution to the digital world that Bitcoin, blockchains, and the like gave us is the concept of digital scarcity. When something is scarce there is a finite supply to go around—like all the gold ore in the world, or clean water.

It used to be that when something got turned into 1’s and 0’s it could be infinitely copied with otherwise indistinguishable results. But blockchains and other distributed ledgers solved core problems around double spending where the same digital money is spent twice. Furthermore their distributed nature meant that there was no centralized authority who could change the rules, or alter some sort of historical log of transactions.

Without going into all of the specifics the above innovations mean that despite something existing in a purely digital space one could cryptographically prove that there are no copies.

How can something digital be truly unique?

Don’t worry if you’re already scratching your head on this one. We’ve been operating with the same core principles in the digital world for a long time, and they’re only recently being upended.

Images can be copied easily. I can send a picture to you, and by the time you receive it there are now two copies. When you send it to someone else now there are three, etc. etc. While I may have taken the original photo, the copies are largely indistinguishable from each other and therefore not unique even though the original may have been at one point.

Turning a photo into an NFT means that you’re imbuing it with certain properties to help identify its provenance and establishing immutable proof of its existence and history. This gets back into the idea of something being scarce—you’re giving that photo new and special properties to help identify it.

So now if that same photo is non-fungible, even though I can make many copies of its pixels, it would be possible to prove what the original is—this precisely is the thing that’s new and particularly exciting.

To bring this back to the real world, while you can purchase a print, postcard, or mousepad of Van Gogh’s “Starry Night”, we all know that there is just one original, which happens to be in the NYC MoMA’s permanent collection. The fact that there are copies of the original doesn’t make it any less valuable or unappealing, in fact one might argue the opposite.

So too we have Murat Yıldırım’s “Furry Night” as seen above. While Van Gogh’s medium was paint, Murat’s was pixels—what you see has never existed in the physical space. Quite obviously I’ve posted a copy above, but because he’s turned it into an NFT, it’s now much more special and scarce—with only “1 of 1” existing as its true original.

What the heck does all this mean?

There’s a lot going on in the above graphic, but here’s a quick primer on what each of the things mean:

-

Wallet: A unique address where cryptocurrency and tokens are held, typically secured by a private key. Basically think of this as your “login,” with the wallet address as your username, and your private key the password.

-

Transaction Hash: Think of this as a receipt. It’s the cryptographic proof that this transaction happened.

-

Block: Which spot in the distributed ledger (in this case a blockchain) the transaction happens to appear. Many transactions are included in a single block.

-

Timestamp: When this transaction occurred

-

From: Which wallet (think of this like a bank account, or a web login of sorts) sent this transaction

-

Interacted With (To): This is where the object went. In this case it was sent to SuperRare, a marketplace of other NFTs, so that it could be listed. In cases when ETH (Ethereum’s native currency) is transferred between parties, it would simply show the receiving party’s wallet.

-

Contract: This is a Smart Contract on the Ethereum blockchain—essentially just some code with special instructions for how to handle a transaction. In this case it was to “mint” this object.

-

Tokens Transferred: In the case of a fungible token, you would see the amount of tokens moving within the transaction. But because the above is an NFT contract, you’re seeing which specific token (the Token ID) moved.

-

ERC-721 Token: Simplistically, this is the code standard or instructions on how a given token should operate. The ERC-721 token standard is what has been popularized for NFTs on the Ethereum network. A newer entrant, the ERC-1155 token standard adds some nifty new features and has seen some recent adoption.

-

Minting: The process of turning something into an NFT. Many of the marketplaces such as OpenSea and Rarible make it easy for anyone to mint.

-

Transaction Fee: How much it costs to mint the object. Running code is not free on the Ethereum network—computers the world over are performing those instructions and “gas” is spent to make it happen. In the example above it cost $55.30 to “mint” Murat’s NFT.

-

Gas Price: Transactions on the Ethereum network cost “gas” to go through. The gas price goes up or down over time depending on the supply and demand of computing power on the network.

-

Ether Price: How much 1 ETH roughly cost at the moment of the transaction

What can be an NFT?

Anything really—or at least anything that can have a digital representation. Here is a short list of examples, though by no means comprehensive:

-

Art: Like you saw above with “Furry Night” or perhaps Beeple’s groundbreaking auction of an NFT with Christie’s auction house. What’s special here is that artists can capture value in secondary sales as well.

-

Collectibles: Think trading cards, figurines, or just about anything that is of a limited edition. Some of the best NFT examples today include NBA Top Shot, Sorare, and CryptoPunks. In Top Shot’s case you collect limited edition video clips of special moments in the NBA.

-

Music: This could mean unique works that are limited edition, or perhaps stems that an original work is comprised of. Recent examples include 3LAU’s NFT release and EulerBeats, a collection of just 27 music originals generated by an algorithm.

-

Tickets: This could be a great example because currently tickets to events are vulnerable to fraud, and exploitative scalping. Folks like Mark Cuban are taking a serious look at making tickets into NFTs, which could also enable the ticket issuer to take advantage of secondary sales.

-

Membership: The idea is that you could have a token that represents membership in something—and its presence in your wallet could be proof without need for logins, etc.

How do they have value?

In an open market, things are valued simply by what the market will bear (what someone is willing to pay). What makes NFTs special is that they are verifiably scarce. That’s why something like CryptoPunks is seeing such high resale value—there’s only 10,000 of them in the world and they are all unique. The total sale value of all of the 8-bit punks at this point is over a staggering $114M.

Even more interesting is that even when works are given away by the artist, such as in the case of Beeple’s $1 raffle with MakersPlace, that hasn’t seemed to affect the resale value in the least.

What about counterfeit works?

I should call out that yes, objects could certainly be minted that are exact copies of something else. However, in the case of NFTs the value is in the contract and its explicit scarcity—verified with the wallet address that it originated from. For instance, Beeple’s wallet is at `0xc6b0562605d35ee710138402b878ffe6f2e23807` and can also be identified with the Ethereum Name Service as `beeple.eth`.

So if there was a counterfeit Beeple floating around out there—and I’m certain there is—it’s extremely easy to look at the source address and discover that no, it didn’t come from the one-and-only.

Will they hold their value?

I have no idea. Plenty of the assets will likely go down, maybe even as much as 99% of them. But the scarcity will remain, and the concepts are here forever now. Not all projects and artists will see mega-high valuations, but some assets like Top Shot’s moments or Beeple’s art feel like they could have some real staying power.

Does this help artists and other creatives?

Without a doubt. For those artists, musicians, storytellers, and other creatives that are willing to put in the effort to make something special and authentically engage with their communities, they will be rewarded handsomely. Beeple’s example is proof—he has shared hundreds of works on his Instagram over the years but up until recently it was primarily Facebook that would have reaped the economic benefit of his contributions. By allowing creators to monetize directly, and continue to receive residuals after the fact, they will begin to have a greater control of their economic story.

Furthermore, the royalty model alone could enable a new kind of success story for creatives that decide to play the long game. It’s conceivable that an artist could enter the space by giving away all works for free, but with scarcity of those works in mind. As that artist gains in popularity, others will begin to bid on the originally free works and ascribe a monetary value to them. That value then return as residuals to the artist. So while in a traditional sense it’s hard for creatives to gain economic value from their earliest works that might have been free initially, the NFT space will flip that on its head where the earliest works could be the most valuable ones.

Have you made any?

In the interest of getting my hands dirty with this, I’ve now since minted a few different objects to see what the process is like from inception to execution and listing. While I have no idea if someone will find them interesting enough to purchase on their own, it felt important to try my hand at the process so that I have direct knowledge of what’s going on.

So far I’ve created and listed:

A 1 of 1 video commemorating 3LAU’s NFT auction:

A video moment capturing 3LAU’s record-setting NFT album auction, created as mixed media commentary on the digital art space.

A cheeky set of old school 16x16 favicons with modern themes:

Each favicon is a 1 of 100 limited edition piece, blending retro web aesthetics with contemporary themes.

What’s newly enabled by this stuff?

The fact that these NFTs exist in digital space, with their sale and transfer governed by software, means that they can be imbued with some really interesting characteristics. Entirely new things that aren’t possible in the “real world” will be enabled here.

-

When minted, it’s possible to set a royalty fee for subsequent transfers of the token. This is a groundbreaking change because it means that artists and purveyors of other digital goods can continue to reap the rewards of an object after it’s left their hands. So while an artist getting off the ground may only sell a piece for a small sum, should they get popular later on, they can still earn a percentage of subsequent sales. When a Beeple piece was sold for $6.6M, Beeple himself received $660,000 with no additional effort.

-

As underscored above, the mere concept of digital scarcity is extremely new—with countless possibilities that I couldn’t even begin to enumerate here. This will open up whole new worlds of functionality and interesting behavior for digital objects.

-

Someone’s wallet address acts as both their personal collection, and verifiable proof of ownership of a given asset or assets. Therefore it’s conceivable that your wallet address could be used as a wholly owned and sovereign, decentralized authentication method to identify oneself. Simply the existence of a “membership token” in one’s wallet would be verifiable proof of their membership, requiring no centralized authority to confirm.

-

Direct transfer between two parties that otherwise do not need to know or understand anything about each other, while trusting the transaction will still go through. It’s impossible to trust an unknown party you may be transacting with on Craigslist, but Ethereum enables transfer without having to trust the other party at all.

Wrapping up…

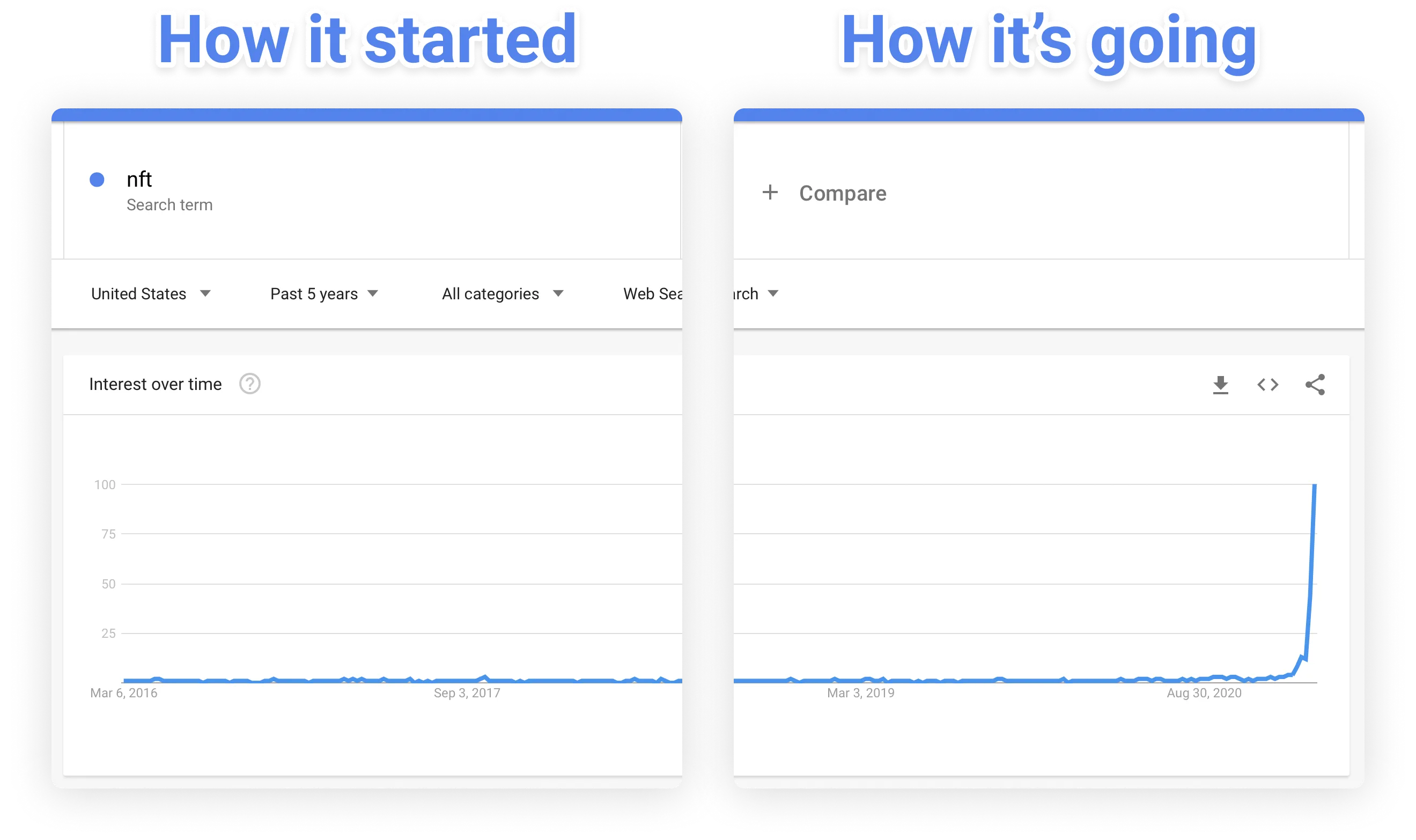

Though this space has been slowly building for years now, the interest and fervor around it has just begun. With every day that passes there seems to be some new development—and it’s overwhelming to take it all in. This appears to be the beginning of something significant—a fundamental shift in what’s possible in the digital world.